As Finance Director for the City of Champaign, I’d like to explain the apparent sales tax increase discussed in recent posts. Readers will be happy to know that sales taxes have not increased recently. The tax rate on most items purchased in Champaign and Urbana is 8.75%, and has not changed since Champaign County voters approved a referendum to add 1% to the sales tax rate to support school construction projects.

So why does a 1% tax rate appear on a sales receipt, along with an 8.75% rate, as mentioned in an earlier post? While the tax rate in Champaign and Urbana is 8.75% on most items, it is only 1% on certain items. The state limits the tax rate on medications and groceries (excluding candy, soft drinks, and alcoholic beverages) to 1% because they are considered necessities. Some retailers show the two different tax rates, and the amount of tax paid at each rate, on their sales receipts.

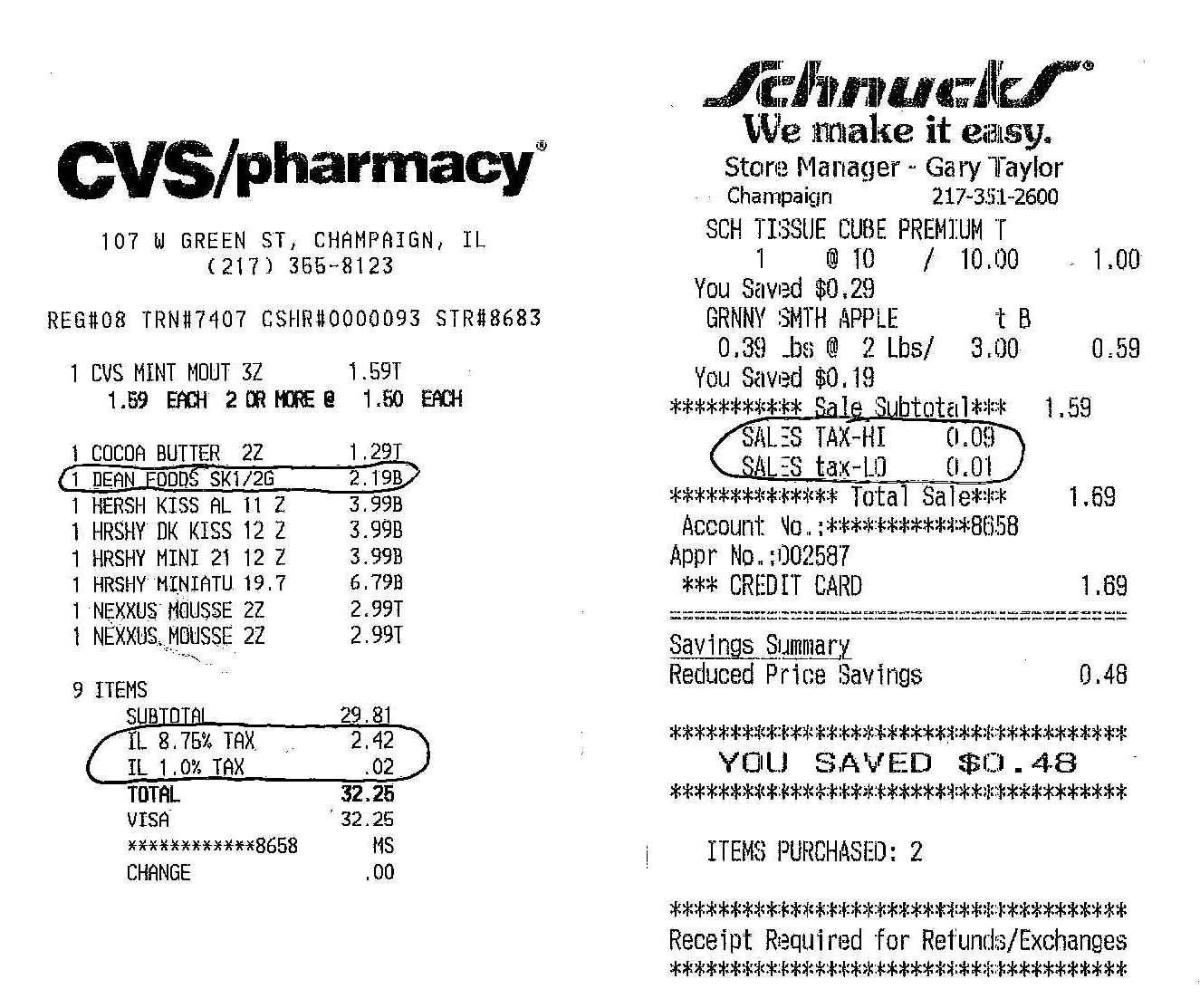

I’ve posted a copy of a receipt from CVS showing just that. The item labeled “1 Dean Foods SK1/2G,” followed by “2.19,” shows the purchase of a half gallon of Dean Foods skim milk costing $2.19. Toward the bottom of the receipt there’s a line stating “”IL 1.0% Tax” followed by ”.02.” The line shows that $0.02 (2 cents, which is 1% of the $2 milk purchase) is the total amount of taxes paid at the 1% tax rate.

The other eight items on the receipt are taxed at the rate of 8.75% as shown by a line starting with “IL 8.75% Tax” followed by “2.42.” Another way to verify that the overall sales tax rate is not 9.75% is to divide the total taxes paid ($2.44) by the total amount of all purchases excluding taxes ($29.81). The result of that computation is 8.19%, which is between the two tax rates.

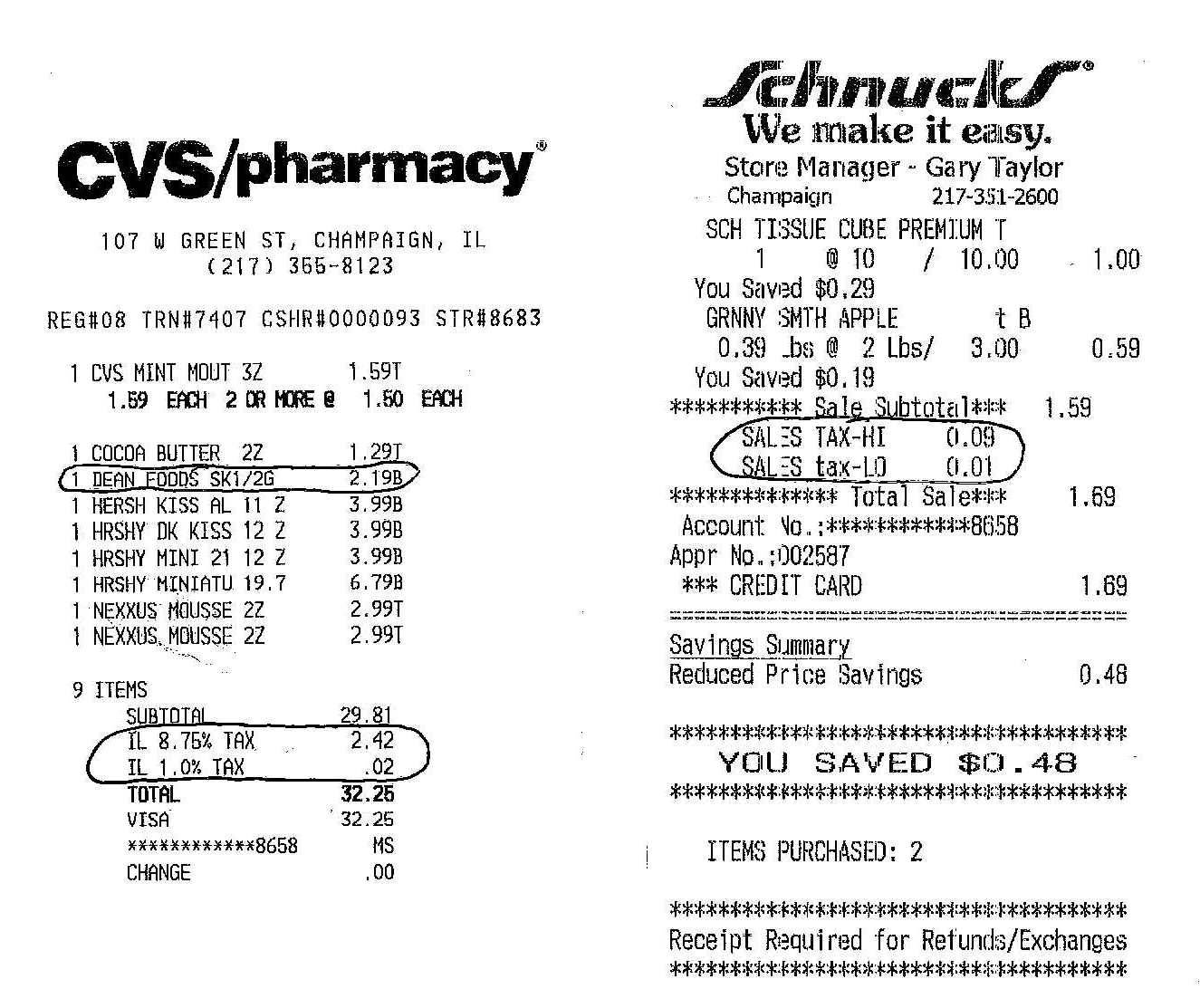

My colleague Leslie Lundy pointed out to me that some retailers indicate that items are taxed at different rates by using the terms “HI” and “LO” on the receipts rather than the exact tax rates. The attachment to this post includes a receipt from Schnucks providing an example of that.

Finally, people still reading this post might be interested to know that the tax on licensed vehicles (cars, boats, trailers, etc.) are taxed at 6.25%. Under state law, additional taxes levied by municipalities, counties, and for school construction do not apply to the purchase of licensed vehicles.

I’d be happy to respond to any questions posted on Smile Politely. You may also email me or call me at 217.403.8943.