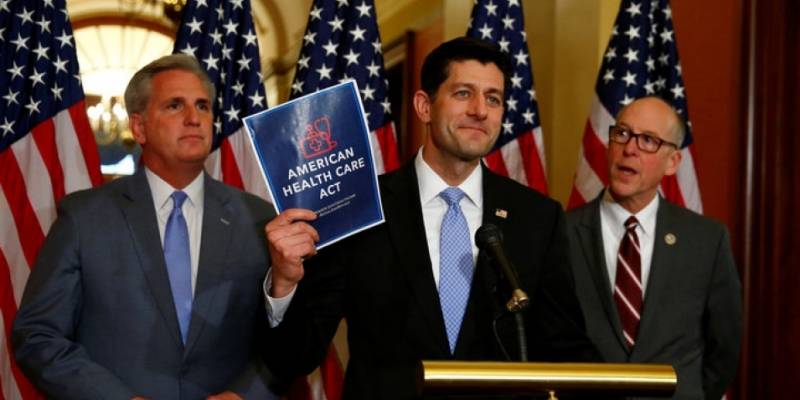

In part 1 of this story I looked at the “repeal” aspect of the the GOP’s bill to repeal and replace the Affordable Care Act, the opposition to it, and Congressman Davis’s bizarre reasoning for supporting it.

In Part 2 I’ll be looking into the “replace” aspect of the bill now known as Republicare. As I mentioned at the end of part 1, the “replace” portion of Republicare has a long road ahead of it due to the substantial hole the “repeal” aspect of the bill digs for itself. Repealing the individual mandate, the ACA’s taxes, and the elimination of the actuarial value mandate make it extremely difficult for this bill to accomplish it’s supposed goals. As it stands it’s unclear how the GOP will pay for it without making drastic cuts to existing programs, how their plan increases the quality of care, and how it will be more affordable for the majority of Americans. It’s important that the replace aspect of the bill accomplish these goals, as Congressman Davis, his conservative colleagues, and the President himself promised the voters they would provide them with a superior alternative to the ACA.

As I look at the “replace” aspect of this bill I want to point out that I do agree with what Congressman Davis and his fellow Republicans have said, in that this is the first draft of Republicare. There will be revisions. Some of the things I discuss will change, the amount of tax credits may increase/decrease, rollout dates for specific portions of the bill may be moved up/pushed back, and some aspects may see significant changes before the final vote is cast. Though as I’ll discuss in part 3, the chances that we see any drastic changes are low due to the speed with which the GOP is trying to force this bill through. In the interest of time, it’s enough to say that although some parts may change, we shouldn’t expect Republicare to morph into Single-Payer as a result of this process. For example, the individual mandate won’t be making a comeback, the elimination of the ACA’s taxes are also likely set in stone, etc., etc.

Important note: Congressman Davis recently said in an interview that he supports the bill even in it’s current form, which seems to cut against his insistence that we “wait and see” before we oppose the bill, as he’s already made up his mind.

Knowing that, it’s more than fair to look at the bill in it’s current form and try to gauge the potential impacts, as it does do a good job of showing us the direction in which the GOP wishes to take our healthcare system, and some of the ways they hope to go about it.

As I discussed in Part 1, the repeal aspect of Republicare gets rid of much of what made the ACA…..the ACA. However, there are many aspects of the existing law that Republicare preserves or keeps more or less unchanged, most notably; mandatory coverage of pre-existing conditions, allowing children/dependents to stay on their parent’s insurance until age 26, the 10 essential health benefits, and a prohibition on annual and lifetime limits.

There’s a reason these particular aspects are sticking around, and it’s a pretty simple one. They’re extremely popular with the general public. Much like making cuts to the essential health benefits, eliminating any of these popular protections would be a PR nightmare for conservatives. However, much like the bait and switch this bill pulls with the essential health benefits (as discussed in Part 1), the promise to “preserve” these protections will be extremely difficult to keep given the way Republicare restructures existing portions of the law. The 2 major modifications to the existing system involved how tax credits are calculated and how Republicare changes the way state Medicaid programs are funded.

To begin with, Republicare make a seemingly innocuous change to how tax credits are calculated. These tax credits are one way that both plans attempt to make insurance more affordable by allowing you to deduct a certain amount of your healthcare costs from your taxes every year. The ACA bases that amount on several factors, namely; your income, what it costs to purchase insurance in your area, and your age. Republicare only really looks at your age. This may not seem like a major change, however, the impact this will have is significant. Under the ACA those that benefited the most from these tax credits were a.) older, b.) sicker, and c.) lived in more rural areas. Republicare turns that on it’s head and provides the lion’s share of the benefits to those that are a.) younger, b.) healthier, and c.) live in larger towns/cities.

For example, under the ACA a 60 year old individual making less than 30K a year receives on average 10,000 per year in tax credits (that number is significantly higher for someone living in a rural area thanks to the way tax credits are calculated under the ACA). Under Republicare, that amount tops out at 3,000 dollars. You’re not reading that wrong, someone making just above the poverty line will see their healthcare costs increase by on average 700% under this plan. Just take a moment to process the impact a 7,000 dollar increase will have on someone making less than 30K a year.

To use a quick personal example: Due to our family income, my wife and I did not qualify for any subsidies or tax credits under the ACA. Under Republicare we would receive a 2,000 tax credit. If you’re an older conservative living in a rural area and making less than 30K a year try to wrap your head around this; your healthcare costs are about to go up by roughly 7000 dollars per year, while this city-dwelling liberal millennial is being given a 2,000 tax break I don’t need and didn’t ask for.

Unfortunately for older Americans the pain doesn’t stop there. Under the ACA, insurance companies could only charge you 3 times more than a younger person. Under Republicare you can now be charged 5 times more than a younger individual. Unsurprisingly, this (among other reasons) has led the AARP to publicly oppose the bill.

The final and most significant change to existing law is in how Republicare handles Medicaid. Under the ACA, 24 Million Americans were able to obtain health insurance where previously they were unable to. This was primarily due to the expansion of Medicaid in more than 30 states. If this law passes, the Medicaid expansion will remain in place until 2020, at which point that expansion will be frozen and funding for state Medicaid programs will be converted into block grants.

According to the Congressional Budget Office, 52 million of Americans will be without insurance, and by 2020 Medicaid’s funding will be cut by 880 billion dollars.

These numbers are in a word….shocking. Unfortunately it doesn’t stop there. For those lucky enough to remain on Medicaid, the news isn’t that much better. That’s due in large part to the way Republicare restructures how Medicaid is funded. Currently (and ever since Medicaid was enacted back in the 70’s) the federal government has agreed to cover all of the costs states incur to provide insurance to those on Medicaid. Under Republicare, states will receive a capped amount with which to pay for their Medicaid programs. If costs exceed the cap set by the federal government (which they will) states will be responsible for picking up the tab.

The effect this will have on state Medicaid programs cannot be understated. As a result of this restructuring, Medicaid’s funding will be cut by 880 billion dollars. Illinois, who as we all know is already struggling to balance its budget, will see a 40 billion dollar reduction in funding. This leaves states with 1 of 4 choices. Reduce the number of people covered, reduce benefit coverage, pay less for those benefits, or ask beneficiaries to pay more. These are the only real ways for states to cut Medicaid spending by the amount required to make up for the decrease in federal funding. None of these options are popular, and none of these options deliver on the promise Congressman Davis and his fellow conservatives made during the election.

It’s also yet another example of conservatives claiming they’re fixing the problem while behind the scenes creating a situation that will result in the most vulnerable among us receiving lower quality care at a higher price. Medicaid overwhelmingly benefits the poor, pregnant women, children, the elderly, and the disabled. Making life more difficult for any of these groups is a PR disaster for anyone crazy enough to try. By wrapping this Medicaid restructuring in misleading language such as “increased freedom and flexibility” and by pushing this painful decision onto the states, conservatives again are trying to have their cake and eat it too.

This bill can’t be all bad though…..can it? Well, no. There are some indications (few as they may be) that this bill will decrease premiums by roughly 10 percent (after rising by as much as 20) for many on the individual market. This is apparently the only part of the CBO’s report Congressman Davis believes is accurate. It also saves roughly 337 billion dollars over the next 10 years, and according to the CBO’s analysis it won’t have the catastrophic effect on the market that I feared it would in Part 1. This is good news right? I can’t possibly find something to complain about here…right?

Wrong. While these cost savings and premium decreases are positives, it’s important to ask who stands to benefit the most from them, and what we have to sacrifice in order produce those results. The CBO’s analysis paint a pretty clear picture. These benefits will primarily go to the young, the healthy, and the wealthy. In a cruel reversal of the current flow of benefits, and contrary to every promise Congressman Davis has made up to this point, these gains will have been earned primarily by making life harder for the poor, the sick, and the old. Costs will go down because less people will have insurance, and those that need insurance the most (who happen to be very expensive to insure) won’t be able to afford it and will simply leave the market. Premiums will decrease because insurance companies will be allowed to offer skimpier plans that benefit young healthy individuals. Unfortunately, those skimpy plans will also be the only ones the poor, elderly, and sick will be able to afford. We save 337 billion dollars because we gut Medicaid, taking insurance from millions off the most vulnerable among us, and leaving behind a less comprehensive more expensive system for those lucky enough to still have insurance.

Is all of this worth it? Are 24 million newly uninsured worth a 10% premium decrease? Is a less comprehensive healthcare system that punishes those most in need of assistance really an acceptable trade-off for shaving .02% off of our federal budget every year?

Congressman Davis and his colleagues clearly believe so. As voters in Congressman Davis’s district, and with next to no way to interact with him, we don’t have a lot of options to explain his position. Either we assume that Congressman Davis doesn’t know how the bill he supports will work, or he does understand that this will be the likely outcome and supports the bill anyways. Either Congressman Davis is woefully uninformed or uneducated on the workings of this bill and healthcare in general, or he’s advocating for a bill that he and his colleagues know will force millions to go without insurance, and force those that remain to pay more for less. Neither of these options leaves me with much confidence in Davis’s ability to truly represent the voters in his district.

In the final installment of this story I’ll wrap everything up and give you my final thoughts on this bill, it’s implications for the future, the process by which it came to be, and my opinion on Congressman Davis’s continuing support for it.