“And as I sat there, brooding on the old, unknown world, I thought of Gatsby’s wonder when he first picked out Daisy’s light at the end of his dock. He had come such a long way to this blue lawn, and his dream must have seemed so close he could hardly fail to grasp it. But what he did not know was that it was already behind him, somewhere in the vast obscurity beyond the city, where the dark fields of the republic rolled on under the night. Gatsby believed in the green light, the orgastic future that year by year recedes before us. It eluded us then, but that’s no matter — tomorrow we will run faster, stretch out our arms farther… And one fine morning — So we beat on, boats against the current, borne back ceaselessly into the past.”

F. Scott Fitzgerald — The Great Gatsby

Here in this high-tech wonderland, we’re dazzled with reports on the redemptive promise of world-class, most-excellent research. And the money will flow into it, and business and the good life will flourish, and we’ll live like the Jetsons.

Here in this high-tech wonderland, we’re dazzled with reports on the redemptive promise of world-class, most-excellent research. And the money will flow into it, and business and the good life will flourish, and we’ll live like the Jetsons.

So what does one of the world’s most successful investors do but go place a bet on the premier technology of the nineteenth century. Warren Buffet is buying a fricking railroad.

Buffett calls this his big bet on America and its future. He’s bought the BNSF, and owns large chunks of Union Pacific and Norfolk Southern, three of the five major railroads in the country. Do we need railroads to ship nanotechnology or the information economy? While one endeavor does not preclude the other, it seems some big bucks are flowing in a different direction than what the high-tech touters tout.

Railroads make most of their money shipping industrial goods, grain, coal, and containers from China and elsewhere. Except perhaps for coal (let’s hope not) and Chinese containers, this does not seem like an industry poised for a lot of growth.

Unless…. unless a lot of stuff now shipped by truck starts moving by rail. Rail does have significant advantages: A much lighter environmental footprint, for one. One train can carry more than 280 trucks and is three times more fuel-efficient. And looking to the future, rail can be more easily and efficiently electrified.

Unless…. unless a lot of stuff now shipped by truck starts moving by rail. Rail does have significant advantages: A much lighter environmental footprint, for one. One train can carry more than 280 trucks and is three times more fuel-efficient. And looking to the future, rail can be more easily and efficiently electrified.

Railroads are acting to regain some of the freight they have lost to trucking, a loss that has been in large measure due to the huge public subsidies to the highway system. One good of interest is fresh produce. Union Pacific, which serves the California fruit and vegetable region, has built new efficient refrigerator cars, and is now running a system to bring produce much more cheaply and efficiently to the east coast, handing off their trains in Chicago to CSX.

So what does this have to do with our little neck of the increasingly close-cropped prairie? At a recent meeting of the Champaign County Economic Development Corporation, president John Dimit asked the businesses on North Lincoln and North Market to speak up in support of the Olympian Drive extension project if they wanted it.

Along North Lincoln is SuperValu, a truck-based food distribution company. On North Market is the Apollo Industrial Park, which contains A. Newell, a large produce shipper that’s part of SuperValu. It’s clear there are private and public interests that want to increase the use of the area just north I-74 as a regional shipping and trans-shipping point. It’s a significant pillar of the region’s economic development plans. As Mark Dixon, the Atkins Development Group’s project manager said a while back in the News-Gazette, “Growth north of Interstate 74 will surge once Olympian Drive is constructed and links major community arterial streets to the interstate highway network.”

Economic development is basic to a good and improving community life, but the question is (besides the mistake of confusing sprawling growth for economic development), are we backing the wrong horse here? Are we betting on the wrong industry? Maybe not in the short term …. but long term? Will Atkins’ Apollo Industrial park someday be as vacant as the big boxes along I-74 or Philo Road?

This is a “wet the beak” strategy that dips into the international flow of goods along the interstates. On one hand, this will be unsustainable as a growth industry as petroleum prices spiral up (i.e. shipping points will move to rail systems). On the other hand, C-U is really just another place in nowhereville. We do have three (or two and a half) interstates, but it’s not that strong a position, and it could be a perpetual scramble to maintain. There are other places that can easily take those industries and jobs in the race-to-the-bottom higgling of the market. Believe it on not, there are places where wages are even lower than in C-U (damn students). There is no inherent geographical reason to have these industries here.

This is a “wet the beak” strategy that dips into the international flow of goods along the interstates. On one hand, this will be unsustainable as a growth industry as petroleum prices spiral up (i.e. shipping points will move to rail systems). On the other hand, C-U is really just another place in nowhereville. We do have three (or two and a half) interstates, but it’s not that strong a position, and it could be a perpetual scramble to maintain. There are other places that can easily take those industries and jobs in the race-to-the-bottom higgling of the market. Believe it on not, there are places where wages are even lower than in C-U (damn students). There is no inherent geographical reason to have these industries here.

This kind of growth also eclipses one of our major resources that is geographically based, leaving it under-developed, ignored and even denigrated. That resource is the soil.

As it is now (mis-) used, our best resource is basically tapped out. It can’t fund the debt spiral it’s underwriting (unless direct and indirect subsidy payments increase substantially, and even then it’s hardly pulling its weight). Price-taker farmers are trapped in a debt cycle, taking on their own capital costs, and cannot, except by government fiat and highly dubious promises about new genetically modified varieties, get beyond making a few hundred dollars an acre at most. This game is all about volume not quality. It’s a commodity export strategy (like the antebellum South), rather than a local investment strategy (the lack of which crippled the South), and the low margins accrue mostly to the big players: ADM, Cargill, the big banks and the traders at LaSalle and Jackson streets.

If this is the only option for the land, then the changes in land-use proposed for the area north of I-74 might make some sense. But it is development plans like this that drive Leslie Cooperband nuts. With a PhD in Soil Science from Ohio State, Cooperband is flabbergasted that we keep paving over one of the top three soils in the world. It seems insane. We have this incredible food-growing resource yet we import most of our food, and we treat this soil, well, like dirt. It could be so much more in so many ways, as shown by Cooperband’s Prairie Fruits Farm, which is in the middle of the contested area. There are other options, but they are not on the radar screens of those calling the economic development shots. And the great opportunities we have for production, processing and employment are DOA.

Take a trip out to High Cross and Olympian and imagine a Market Place Mall on that corner. That’s how far the planning scheme extends right now. The county planners’ proposed long-range plan (2010 to 2035) projects federal funding of $275 million, state funding of $92 million and local transportation funding of $2.3 billion (that’s billion with a B).

That averages out to $108 million dollars per year in local funding. What else could be done with that money? (In fairness, most of that is not for new road construction, but still….) The average cost of light rail in the U.S. is $35 million per mile. It would likely be much lower in C-U. Let’s use $25 million per mile as a conservative figure. If you took just one year of that local funding (never mind the federal dollars that might also be available), you could build four miles of line. From Neil and University in downtown Champaign, to the Beckman, to Wright and Green then to downtown Urbana is about 2.5 miles. Figure what other spokes to the central cities and university might cost, and how many years of local funding alone would be needed (not much). Then figure out what could be done with the wasted space of parking lots as they became less necessary. (Maybe use them for manufacturing sites instead of sites on the periphery?)

That averages out to $108 million dollars per year in local funding. What else could be done with that money? (In fairness, most of that is not for new road construction, but still….) The average cost of light rail in the U.S. is $35 million per mile. It would likely be much lower in C-U. Let’s use $25 million per mile as a conservative figure. If you took just one year of that local funding (never mind the federal dollars that might also be available), you could build four miles of line. From Neil and University in downtown Champaign, to the Beckman, to Wright and Green then to downtown Urbana is about 2.5 miles. Figure what other spokes to the central cities and university might cost, and how many years of local funding alone would be needed (not much). Then figure out what could be done with the wasted space of parking lots as they became less necessary. (Maybe use them for manufacturing sites instead of sites on the periphery?)

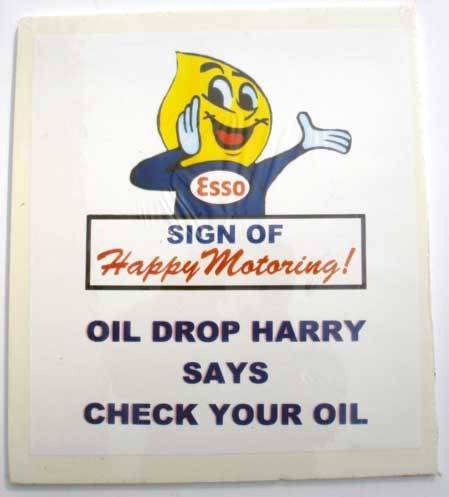

Maybe the basic assumptions — running faster, stretching out our arms farther — are ultimately destructive. We can’t live in a post-agricultural society, and the happy-motoring, low-density, suburban society cannot efficiently continue in the face of declining cheap energy. There are steeply rising production costs on the margins of further fossil fuel development, not to mention the huge pollution, environmental destruction, and global warming costs. To go on as before is a pipe dream, yet we continue to smash things up.

The problem of thinking globally, acting locally is that we can’t think locally. We seem to be stuck with anachronistic development models while the world shifts, and we can’t get our head around a different way of doing things.